NEWS

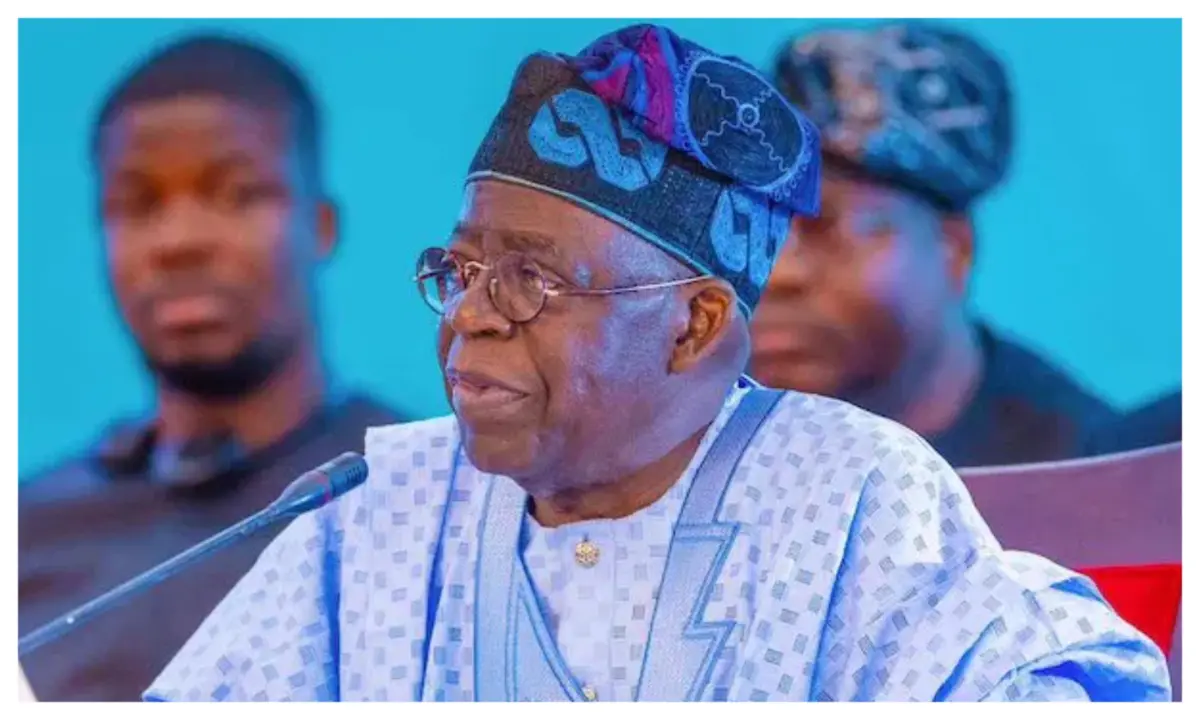

Debt Refinancing: Tinubu Seeks NASS Approval for $2.3 Billion External Borrowing and $500 Million Sukuk Issuance

President Bola Ahmed Tinubu has formally requested the National Assembly’s approval for a significant external financing package, seeking to secure $2.3 billion in new borrowing and debt refinancing, alongside a debut issuance of a $500 million sovereign Sukuk in the international capital market. The total funding sought amounts to $2.8 billion.

Dependable NG reports that the President communicated this request to the House of Representatives via a letter read on the floor by Speaker Tajudeen Abbas. The communication explicitly invoked Sections 21(1) and 27(1) of the Debt Management Office (DMO) Establishment Act of 2003, seeking a legislative resolution to authorize these key fiscal measures for the 2025 financial year.

The core purpose of this expansive borrowing plan is threefold: to fund critical components of the 2025 Appropriation Act, to strategically refinance maturing debt obligations, and to successfully diversify the nation’s funding sources by tapping into Islamic finance instruments on the global stage. The President detailed that the 2025 budget projects a total new borrowing requirement of $9.27 billion to finance the fiscal deficit, with $1.84 billion (equivalent to N1.23 trillion at an exchange rate of N1,500/$) specifically earmarked for external loans.

A critical component of the refinancing strategy is the management of a maturing $1.118 billion Eurobond, which was originally issued in 2018 at a coupon rate of 7.625% and is due for payment in November 2025. President Tinubu described the planned refinancing—through either new Eurobonds or syndicated loans—as a “standard practice in debt capital markets,” essential for maintaining debt sustainability and upholding investor confidence.

To execute the entire borrowing strategy, the President urged lawmakers to grant authorization for the Federal Government to utilize a variety of channels, including the Issuance of Eurobonds, Loan Syndication, Bridge Financing from bookrunners, or Direct borrowing from international financial institutions.

Furthermore, the President highlighted the government’s “considerable success” with domestic Sukuk issuances, which have collectively raised N1.39 trillion since 2017 for numerous road projects and other critical infrastructure developments. This strong domestic performance has inspired the ambitious move to issue a $500 million international Sukuk. This debut move into the global non-interest finance market is aimed squarely at bridging the country’s vast infrastructure funding gap and significantly deepening Nigeria’s external investor base.

The plan also includes a provision that, should the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) guarantee be utilized, 25% of the proceeds would be dedicated to repaying “relatively expensive debt obligations,” with the remaining balance financing pre-identified infrastructure projects. President Tinubu assured the House that the Federal Ministry of Finance and the DMO are committed to working with transaction advisers to secure the most favorable terms and pricing for all capital-raising efforts, keeping prevailing global market conditions in sharp focus.